Florida Real Estate Transfer Tax Form . So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. This fee is charged by the recording offices in most counties. The florida department of revenue's property tax oversight program provides commonly requested tax. In florida, transfer tax is referred to as a documentary stamp tax. A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. People who transfer real estate by deed must pay a transfer fee.

from www.sampleforms.com

In florida, transfer tax is referred to as a documentary stamp tax. This fee is charged by the recording offices in most counties. The florida department of revenue's property tax oversight program provides commonly requested tax. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. People who transfer real estate by deed must pay a transfer fee.

FREE 10+ Sample Property Transfer Forms in PDF Word XLS

Florida Real Estate Transfer Tax Form Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. People who transfer real estate by deed must pay a transfer fee. This fee is charged by the recording offices in most counties. In florida, transfer tax is referred to as a documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. The florida department of revenue's property tax oversight program provides commonly requested tax. A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold.

From www.contrapositionmagazine.com

Florida Real Estate Contract Sample Form Resume Examples yKVBbNolVM Florida Real Estate Transfer Tax Form This fee is charged by the recording offices in most counties. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. People who transfer real estate by deed must pay a transfer fee. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the. Florida Real Estate Transfer Tax Form.

From www.formsbirds.com

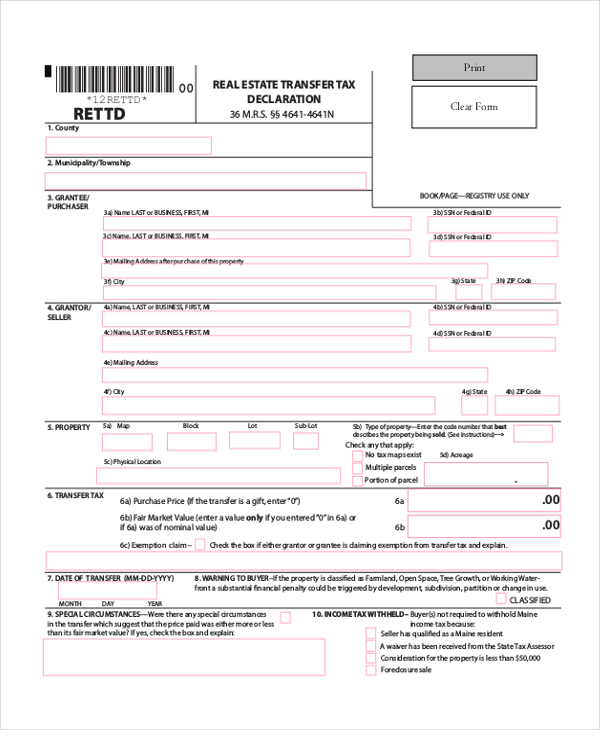

Combined Real Estate Transfer Tax Return Form Free Download Florida Real Estate Transfer Tax Form Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. In florida, transfer tax is referred to as a documentary stamp tax. This fee is charged by the recording offices in most counties. People who transfer real estate by deed must pay a transfer fee. Statewide, real estate. Florida Real Estate Transfer Tax Form.

From www.childforallseasons.com

Florida Real Estate Transfer Tax Forms Form Resume Examples Mj1vgrlKwy Florida Real Estate Transfer Tax Form Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is. Florida Real Estate Transfer Tax Form.

From www.dochub.com

Cook county real estate transfer declaration Fill out & sign online Florida Real Estate Transfer Tax Form Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. The florida department of revenue's property tax oversight program provides commonly requested tax. People who transfer real estate by deed must pay. Florida Real Estate Transfer Tax Form.

From asrlawfirm.com

Real Property Transfer Taxes in Florida ASR Law Firm Florida Real Estate Transfer Tax Form A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. People who transfer real estate by deed must pay a transfer fee. The florida department of revenue's property tax oversight program provides commonly requested tax. Deeds and other documents that transfer an interest in florida real property are subject. Florida Real Estate Transfer Tax Form.

From www.slideshare.net

Real Estate Transfer Tax Declaration of Consideration Florida Real Estate Transfer Tax Form People who transfer real estate by deed must pay a transfer fee. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. A document that transfers an interest in real property between. Florida Real Estate Transfer Tax Form.

From www.formsbank.com

Oak Lawn Real Estate Transfer Tax Form printable pdf download Florida Real Estate Transfer Tax Form The florida department of revenue's property tax oversight program provides commonly requested tax. People who transfer real estate by deed must pay a transfer fee. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. A document that transfers an interest in real property between a husband and wife. Florida Real Estate Transfer Tax Form.

From www.sampleforms.com

FREE 10+ Sample Property Transfer Forms in PDF Word XLS Florida Real Estate Transfer Tax Form So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. This fee is charged by the recording offices in most counties. Statewide, real estate transfers are taxed. Florida Real Estate Transfer Tax Form.

From www.sampleforms.com

FREE 10+ Property Transfer Forms in PDF Ms Word Excel Florida Real Estate Transfer Tax Form This fee is charged by the recording offices in most counties. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. People who transfer real estate by deed must pay a transfer fee. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp. Florida Real Estate Transfer Tax Form.

From www.formsbirds.com

Pennsylvania Realty Transfer Tax 8 Free Templates in PDF, Word, Excel Florida Real Estate Transfer Tax Form A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. People who transfer real estate by deed must pay a transfer fee. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. Florida levies a documentary stamp tax on deed transfers,. Florida Real Estate Transfer Tax Form.

From www.contrapositionmagazine.com

Florida Enhanced Life Estate Deed Template Form Resume Examples Florida Real Estate Transfer Tax Form People who transfer real estate by deed must pay a transfer fee. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. This fee is charged by the recording. Florida Real Estate Transfer Tax Form.

From www.hotzxgirl.com

Free Property Transfer Forms In Pdf Ms Word Excel Hot Sex Picture Florida Real Estate Transfer Tax Form So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. This fee is charged by the recording offices in most counties. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. The florida department of revenue's property tax oversight. Florida Real Estate Transfer Tax Form.

From asrlawfirm.com

Real Property Transfer Taxes in Florida ASR Law Firm Florida Real Estate Transfer Tax Form So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. People who transfer real estate by deed must pay a transfer fee. In florida, transfer tax is referred to. Florida Real Estate Transfer Tax Form.

From www.formsbirds.com

Combined Real Estate Transfer Tax Return Form Free Download Florida Real Estate Transfer Tax Form A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily. Florida Real Estate Transfer Tax Form.

From www.uslegalforms.com

Hoa Addendum Florida 20202022 Fill and Sign Printable Template Online Florida Real Estate Transfer Tax Form People who transfer real estate by deed must pay a transfer fee. So, what do you need to be aware of when it comes to florida’s real estate transfer tax, primarily as it. A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. In florida, transfer tax is referred. Florida Real Estate Transfer Tax Form.

From www.formsbank.com

Real Estate Transfer Tax Claim For Refund printable pdf download Florida Real Estate Transfer Tax Form This fee is charged by the recording offices in most counties. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. A document that transfers an interest in real property between a husband and wife may be subject to documentary stamp tax. In florida, transfer tax is referred to as. Florida Real Estate Transfer Tax Form.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Florida Real Estate Transfer Tax Form This fee is charged by the recording offices in most counties. In florida, transfer tax is referred to as a documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property. People who transfer real estate by deed must pay a transfer fee. So, what do you need. Florida Real Estate Transfer Tax Form.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Florida Real Estate Transfer Tax Form Florida levies a documentary stamp tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. Deeds and other documents that transfer an interest in florida real property are subject to documentary stamp tax. Statewide, real estate transfers are taxed at a rate of $0.70 per $100 of the total value of the property.. Florida Real Estate Transfer Tax Form.